How India’s suspension of sugar exports will have an effect on import-reliant Arab nations

RIYADH/DUBAI:Arab nations are braced for a pointy rise within the value of all issues candy after it emerged this week that India, a serious provider of agricultural merchandise to import-reliant Center East, plans to droop sugar exports from this October till September subsequent 12 months.

In accordance with three Indian authorities sources who spoke to Reuters information company, New Delhi imposed the 11-month ban — the primary of its type in seven years — primarily because of lowered cane yields brought on by a scarcity of rain over the summer time monsoon season.

“This potential ban stems from insufficient rainfall in crucial sugarcane cultivating districts,” Pushan Sharma, director of analysis at CRISIL Market Intelligence and Analytics, informed Arab Information.

Though rainfall distribution within the sugarcane-growing states of Uttar Pradesh, Maharashtra, and Karnataka was regular this summer time, Sharma says “just a few key districts have obtained lesser rainfall, and the yields are anticipated to be decrease” within the 2023-24 sugar season.

The autumn in manufacturing is a serious concern for the sugar business as these states alone account for greater than half of India’s whole sugar output.

Lowered manufacturing in India and the nation’s absence from the world market will undoubtedly trigger value will increase at a time when sugar was already buying and selling at multi-year highs.

There at the moment are renewed fears of additional inflation in world meals markets, significantly within the Arab world, which buys a lot of its sugar from India.

“There are some Arab nations that will be unable to soak up the worth improve shock, and it will have an effect on its imports, its inventory, and the distribution course of,” Fadel El-Zubi, a lead advisor for the UN Meals and Agriculture Group in Jordan, informed Arab Information.

“These Arab nations will witness additional inflation, at a time when their native currencies are already weak.” Due to this fact, these nations have to take proactive measures forward of anticipated disruptions within the meals market, he stated.

Arab nations is not going to climate future value fluctuations “except they begin implementing the appropriate meals system and steadily improve self-sufficiency.”

Whereas these nations don’t essentially want to attain whole self-sufficiency, El-Zubi added, they do want to extend the present degree of manufacturing and rely much less on importing meals gadgets.

El-Zubi predicts “some consumption habits” will change on account of the sugar export suspension, however such a change “can’t occur in a single day.”

FASTFACTS

India to droop sugar exports from October 2023 to September 2024.

Center East nations are main importers of Indian sugar.

Transfer is anticipated to extend meals inflation within the Arab world.

The rise in crude oil costs in recent times, which invariably impacted the price of freight, had made India a well-liked alternative for Center Jap sugar importers, given its relative proximity in comparison with different main sugar producers like far-flung Brazil.

However, Arab nations, primarily in North Africa, imported roughly 10 p.c of Brazil’s sugar exports within the first quarter of 2023.

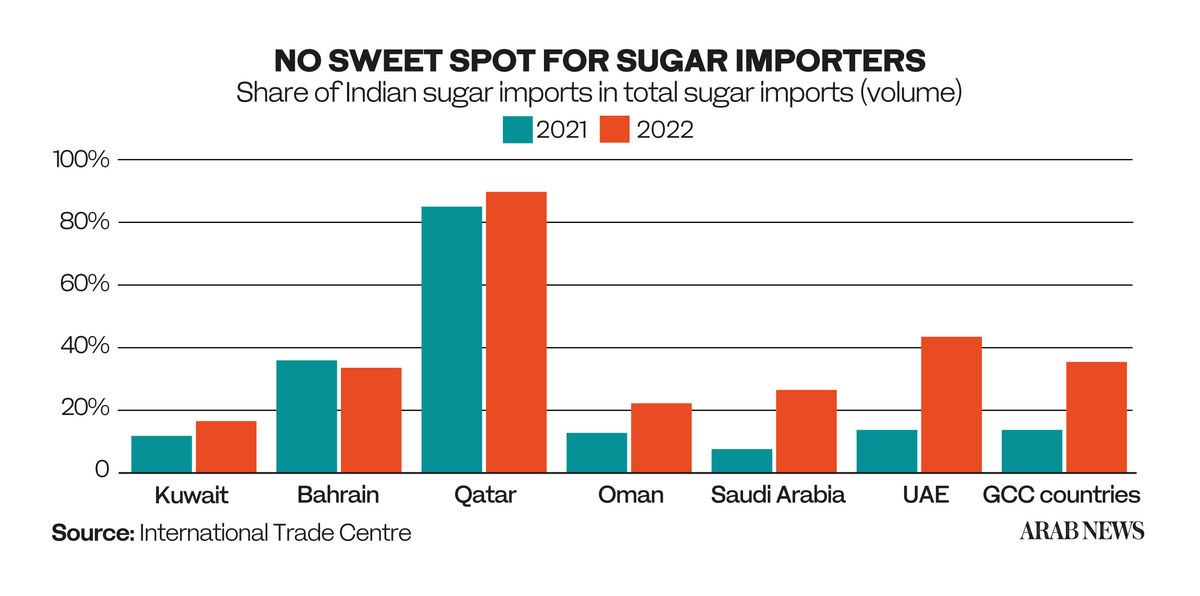

Final 12 months, Qatar imported 90 p.c of its sugar from India, the UAE 43 p.c, Bahrain 34 p.c, and Saudi Arabia and Kuwait 28 p.c every, in keeping with figures from the Worldwide Commerce Heart.

Sugar is a staple ingredient in Gulf Cooperation Council nations, making them particularly vulnerable to cost rises on account of the export suspension.

“Since all GCC nations have important dependency on Indian sugar, an export ban in India would result in decrease provides within the world market, making imports costlier for all sugar-importing nations,” stated Sharma.

And these nations is not going to discover it straightforward to seek out new or substitute sources for his or her sugar within the meantime.

“Whereas these units of restrictions will pressure the Arab world to diversify their provide sources, it should take time to alter suppliers,” Anupam Manur, an assistant professor on the Bangalore-based Takshashila Establishment, informed Arab Information.

“Within the short-run, larger meals inflation will probably be seen.”

Regardless of these predictable ramifications, the Indian authorities has concluded the ban was a vital step.

“Home concerns come into play within the ban. The federal government is wanting on the home shoppers’ curiosity,” Gokul Patnaik, chairman of World AgriSystem Pvt. Ltd. and former director of the Agricultural and Processed Meals Merchandise Export Improvement Authority, informed Arab Information.

“Farmers and growers could make some cash by means of elevated costs. Within the case of onions, the growers are affected straight. Within the case of sugar (a processed product), it’s an oblique impact. But it surely harms the growers in all circumstances.”

For Manur, a sample is rising in India’s agricultural commerce coverage. New Delhi’s “successive restrictions on export” clearly point out it seeks to “prioritize home provide necessities” over export earnings, he stated.

Total retail inflation in India was additionally a latest concern, with the patron value index leaping to a 15-month excessive of seven.44 p.c in July and meals inflation to 11.5 p.c, its highest in over three years.

“Nevertheless, inflation is as a lot a results of demand-supply mismatches as it’s with shopper expectations,” stated Manur.

“Sarcastically, by endeavor this sequence of restrictions on exports, it’s sending a sign of shortage, and that may drive up costs by itself. It additionally diminishes incentives on the margin for elevated manufacturing.”

India has confirmed to be one of many fastest-growing sugar exporters in recent times. Final 12 months, it was the second-largest exporter of the commodity worldwide, promoting $5.7 billion value, up from a relatively paltry $810.9 million in 2017.

New Delhi’s elevated sugar exports could be attributed to various components starting from favorable climate circumstances to rising home sugar manufacturing and authorities insurance policies supporting sugar exports.

“India holds the place of the second-largest sugar exporter globally after Brazil, contributing to fifteen p.c of world exports,” stated Sharma.

“Nevertheless, for the October 2022 to September 2023 sugar season, the export share is anticipated to say no to 11 p.c because of a big drop in exports.”

Sugar isn’t the one Indian meals export that has confirmed unreliable in latest months.

The nation shocked overseas shoppers final month by imposing a ban on non-basmati white rice exports. It additionally set a 40 p.c obligation on onion exports in an try to stabilize meals costs forward of state elections later this 12 months.

“This sort of knee-jerk response of banning the export isn’t good for our well-being as a long-term exporter,” stated Patnaik. “At greatest, there could be changes in export taxes, however the whole ban shouldn’t be accomplished.

“In the event you ban, you lose credibility as a long-term provider. The ban will little question have an effect on the Arab world. However it should additionally have an effect on India’s credibility.”

Manur concurred with this evaluation. “India would possibly expertise strained buying and selling relations with its buying and selling companions and will end in both retaliatory tariffs or the lack of negotiating energy in future commerce talks,” he stated.

“Additional, this could harm India in the long term as many nations would scramble to diversify their meals suppliers.”

Within the quick time period, it might negatively affect poorer nations within the Arab world, the place meals safety is already a priority, particularly for the reason that onset of the Russia-Ukraine battle, which threatens to imperil grain exports to main importers.

Whereas main sugar-importing nations just like the UAE have enough monetary cushioning to take care of elevated meals costs, growing nations within the area don’t.

(With Ameen Sayed & Sanjay Kumar in New Delhi)